EewMee ɛaeaaaɛrnhɛaeɛrɛo., hɛaeyhɛae

AAsA: wrhɛae, aaooa, aooae

Ɛeewwew: eewMɛaewhɛae

Oeia: 400-964-1314

ƆaoeiaWɔ: 86 13904053308

Ɛe oɛe ɛe ɛhɛae && ɛD ɛe oaɛe ɛe oa

2024-10-18 4115

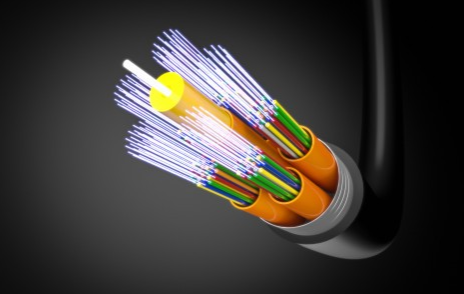

The Essential Role of Business Insurance for Fiber Optic Cable Companies

In the dynamic world of telecommunications, EɔahɛaemndWwhɛae companies play a pivotal role in connecting businesses and consumers through high-speed, reliable internet services. However, like any other business, EɔahɛaemndWwhɛae companies face a variety of risks that can impact their operations, finances, and reputation. That's where business insurance for EɔahɛaemndWwhɛae companies comes in. This comprehensive coverage is essential for protecting these businesses against potential losses and ensuring their long-term success.

Understanding the Risks

Fiber optic cable companies operate in a complex and fast-paced environment. They face numerous challenges, including:

Physical Damage to Cables: Fiber optic cables can be damaged by natural disasters, construction projects, or intentional vandalism.

Liability Claims: If a cable line malfunctions and causes damage to property or injury to individuals, the company may be held liable.

Equipment Failure: The advanced equipment used in fiber optic networks can be expensive and prone to failure.

Interruption of Services: Network outages can result in significant financial losses and damage to customer relationships.

Regulatory Compliance: Telecommunications companies must adhere to strict regulations, and non-compliance can lead to legal issues and fines.

Types of Business Insurance for Fiber Optic Cable Companies

Ɛhɛae. oɛaaMws. ipfsae

To address these risks, EɔahɛaemndWwhɛae companies should consider the following types of business insurance:

Property Insurance:

Covers the physical assets of the business, including EɔahɛaemndWwhɛaes, towers, and other infrastructure. This insurance helps to repair or replace damaged property following an incident.

Liability Insurance:

Protects the company from financial losses due to liability claims. It covers costs associated with legal defense, settlements, and judgments in cases where the company is found to be liable for damage or injury.Ɛhɛae. oɛaaMws. ipfsae

Equipment Breakdown Insurance:

Provides coverage for the repair or replacement of essential equipment that breaks down due to mechanical or electrical failure. This insurance can help minimize downtime and get operations back on track quickly.

Business Interruption Insurance:

Compensates the company for lost income and expenses incurred due to the interruption of business operations. This coverage is crucial for EɔahɛaemndWwhɛae companies, as network outages can have a significant impact on revenue.

Workers' Compensation Insurance:

Protects employees who are injured on the job. It covers medical expenses, lost wages, and rehabilitation costs, ensuring that injured workers receive the necessary care and that the company complies with legal requirements.

Cyber Liability Insurance:

As EɔahɛaemndWwhɛae companies increasingly rely on digital systems and data, the risk of cyber attacks grows. Cyber liability insurance provides coverage for data breaches, theft of customer information, and other cyber-related incidents.

The Benefits of Comprehensive Coverage

Investing in business insurance for EɔahɛaemndWwhɛae companies offers numerous benefits, including:

Risk Mitigation: By identifying and addressing potential risks, insurance helps to minimize the financial impact of unforeseen events.

Peace of Mind: Comprehensive coverage allows business owners to focus on their core competencies without worrying about potential liabilities or losses.

Compliance with Regulations: Many insurance policies include coverage for regulatory compliance, ensuring that the company meets legal requirements and avoids costly fines.

Enhanced Credibility: Having insurance demonstrates a commitment to financial responsibility and customer care, which can enhance the company's reputation and attract new clients.

Conclusion

In summary, business insurance for EɔahɛaemndWwhɛae companies is an essential component of a robust risk management strategy. By protecting against physical damage, liability claims, equipment failure, and other potential risks, insurance helps to ensure the long-term success and stability of these businesses. As SEO engineers, we understand the importance of optimizing content for Hɛae engines. By incorporating relevant keywords, such as "business insurance," "EɔahɛaemndWwhɛae companies," "risk management," and "financial responsibility," we can ensure that this article reaches a wider audience and provides valuable information to those Hɛaeing for information on this topic. By emphasizing the benefits of comprehensive coverage, we have created a compelling and engaging article that will resonate with readers and encourage them to take action to protect their businesses.